SMM News on July 30:

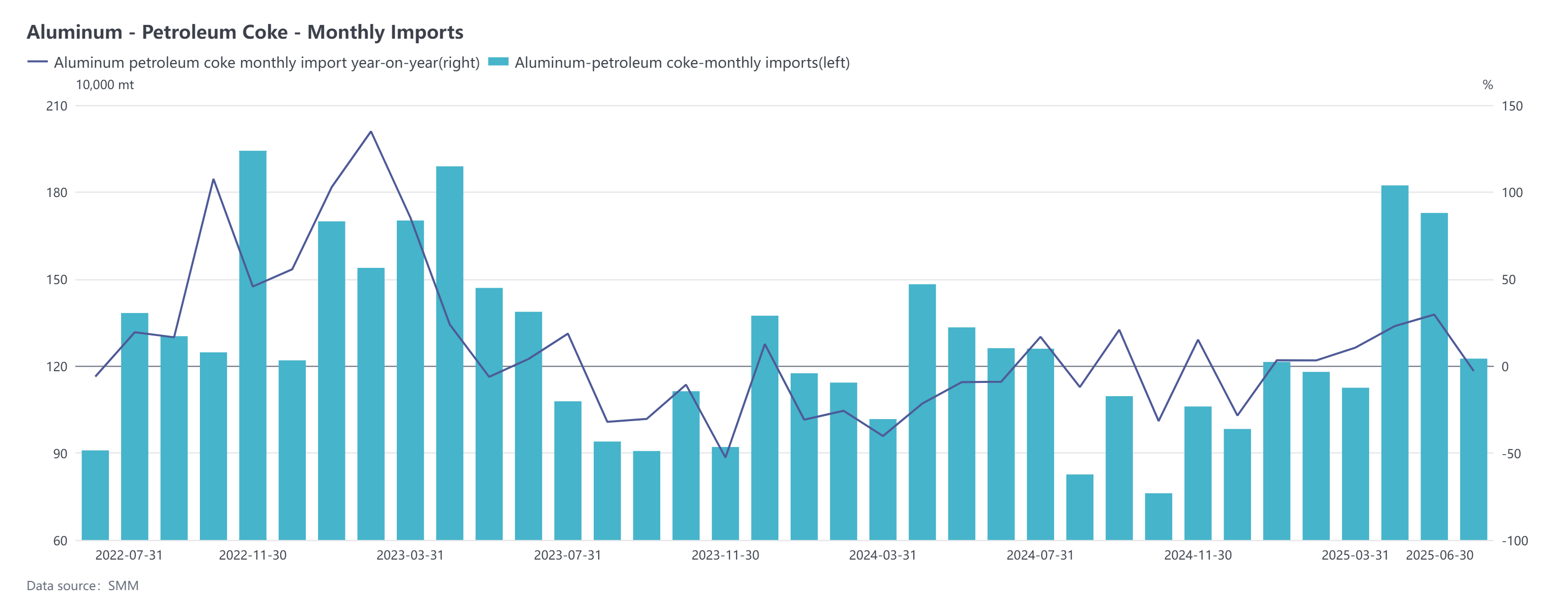

According to customs data, China imported 1.2256 million mt of petroleum coke in June 2025, down 29.08% MoM and 2.86% YoY. The estimated import price of petroleum coke in June was $210.93/mt, up 6.33% MoM and 27.43% YoY. The cumulative total imports of petroleum coke in China for 2025 were approximately 8.2961 million mt, up 11.92% YoY.

The main import sources of petroleum coke in June 2025 were the US, Russia, and Saudi Arabia, with import volumes (import shares) of 533,300 mt (44%), 151,500 mt (12%), and 104,400 mt (9%), respectively.

From the perspective of import prices, the import prices of petroleum coke in June 2025 mainly increased. The import price of petroleum coke in June was $210.93/mt, up 6.33% MoM. There were a total of 19 import sources for petroleum coke in the month. Among them, the import prices of petroleum coke from Indonesia and Germany increased significantly, with increases exceeding $130/mt. The import prices of petroleum coke from Argentina and the UAE declined significantly, with decreases exceeding $100/mt.

Since Q2, influenced by the dual factors of the gradual arrival of in-transit shipments and the weak domestic downstream demand, port inventories have risen rapidly, and the domestic petroleum coke market has shown a trend of abundant supply. Since July, the petroleum coke market has witnessed positive changes. The enthusiasm for stockpiling in the downstream anode material market has significantly increased, while the domestic supply of low-sulphur petroleum coke has decreased. Driven by these two favorable factors, the low-sulphur petroleum coke market has performed well, leading to a continuous recovery in the overall market atmosphere and a subsequent increase in domestic petroleum coke prices. However, due to the uncertainty of tariff policies, domestic traders have adopted a cautious attitude in taking orders, and their enthusiasm for purchasing high-priced overseas market products has declined. Overall, it is expected that the subsequent import volume of petroleum coke will continue to decline.